According to the investment firm, hedge funds and asset managers are starting to view Bitcoin (BTC) as an effective portfolio diversifier because of its potential to hedge against inflation. Unlike gold, Bitcoin’s immutable transaction history makes it less susceptible to fraud, while its ability to be divided into smaller units renders it a superior form of payment.

VanEck Says Bitcoin Can Improve Returns With Minimal Downside

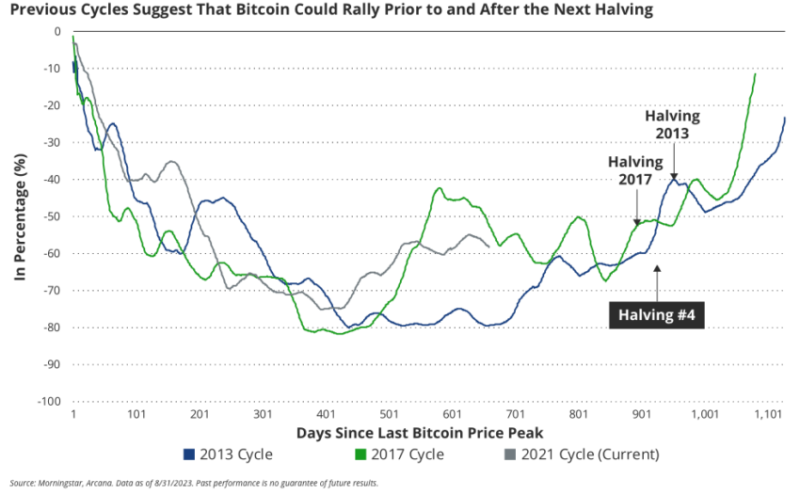

VanEck also confirmed that Bitcoin improved returns without significant risk in portfolios, with 40% allocated to bonds and 60% allocated to equities. The company expects the asset’s price to rise before and after the spring 2024 halving, a process that reduces the amount of Bitcoin released for every successfully mined block.

VanEck suggests Bitcoin could rally before and after the next halving | Source: VanEck

The new Bitcoin RGB Layer 2 upgrade will improve the utility of the network by allowing investors to tokenize bonds and other assets using the existing structure of the Bitcoin network. Earlier this year, Citi predicted the tokenization of assets in private markets like real estate would increase 80x by 2030.

Tokenization digitizes assets that buyers and sellers can exchange over the blockchain. So far, most projects have settled asset transfers over permissioned blockchains instead of public networks like Bitcoin.

Spot Bitcoin Approval Could Threaten Futures ETFs

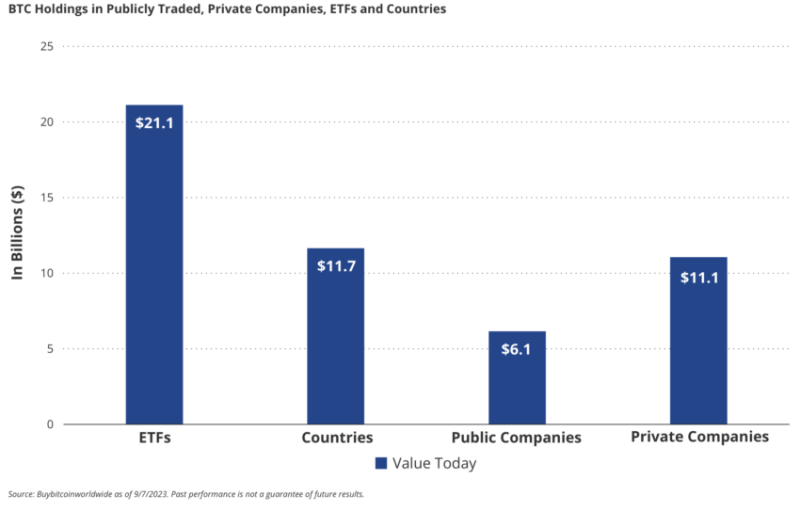

VanEck operates a Bitcoin futures-based exchange-traded fund with roughly $44 million in assets under management. The US Securities and Exchange Commission has yet to approve a US spot bitcoin ETF, which analysts believe will be preferable to a futures fund for holding Bitcoin over longer periods.

Bitcoin holdings of institutions ahead of spot ETF approval | Source: VanEck

VanEck has joined several Wall Street heavyweights, including Fidelity, Invesco, Bitwise, and BlackRock, which have applied to launch a spot Bitcoin ETF. Unlike the futures ETF, which tracks the prices of futures contracts tied to the Bitcoin price, the spot product will give investors direct exposure to Bitcoin.

The tried-and-tested ETF vehicle will likely cause significant investor inflows that could see it balloon into a $100 billion market. It may also cause outflows from futures-based funds, which are less capital-efficient.