Financial institutions, aware of the significant victories in the battle against regulators over digital assets and how to classify them, are overcoming the stigma of an asset class that many in government still despise. And, they are experimenting with increasing boldness in the digital assets space.

Citi to Implement Tokenized Deposits and Payments

According to Bloomberg and other sources, the bank will expand its suite of offerings to allow clients to make tokenized cross-border deposits. Although, Citi is not pitching these new offerings to all clients, but to powerful institutional ones.

The new offerings are the fruit of a partnership with Maersk. The two partners worked together to devise a solution. It deploys smart contracts to send tokenized payments to service providers, among others.

Ideally, the new system will slash transaction times that might have dragged over days into the work of a few minutes or seconds. Moreover, it purports to be a boon for customers engaging in trading and payments across time zones.

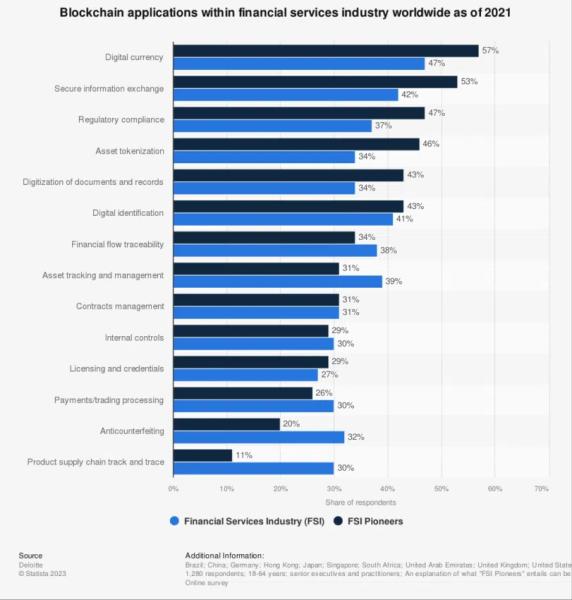

Citi Treasury and Trade Solutions has joined financial institutions worldwide in making blockchain-based tokenized solutions available. Source: Deloitte

Citi Has Been Circling the Crypto Wagons for Months

Monday’s news may be a shock to some. But, actually, Citi has been testing the waters of the digital asset space for some time.

For those who have followed Citi’s activities in recent months, Monday’s news is no surprise. It offers confirmation that the bank does not wish rivals to overtake it in the race to meet growing crypto demand.

In June, reports emerged that Citi had engaged in talks with crypto custodian Metaco, which Ripple recently acquired. Moreover, back in June 2022, Metaco had made its Harmonize platform available to Citi so the latter could test out the tokenization of assets.

The ultimate goal? To facilitate the conversion of funds into tokenized assets that can transmit instantly and outside of business hours.

Metaco aims to keep assets safe from hacking and theft by using multi-key wallets. And, by storing the wallets offline and out of reach of bad actors.

And, in October 2022, Citigroup took the lead in a funding round granting $6 million in seed funding to Xalts. The latter is a Hong Kong-based asset manager active in the digital assets and exchange-traded funds (ETF) space.