At the paper’s core is the argument that crypto assets can hurt a country’s financial stability and introduce macroeconomic risks.

IMF and FSB Urge Governments to Protect Central Banks

For example, saving money using a foreign currency-based stablecoin weakens the impact of monetary policy. Attractive foreign regulatory regimes could cause capital flight. At the same time, citizens could convert their savings into foreign currency-denominated stablecoins and reduce the availability of funds available for local investments.

Inconsistent guidelines on crypto tax and granting crypto legal tender status can also hurt government revenue. The agencies noted these implications generally affect countries whose weak policies stimulate the search for alternative money.

To lower risk, governments must ensure that central banks focus on preserving “monetary sovereignty” instead of needing to print money to erase deficits. They must also not grant crypto assets the status of legal tender.

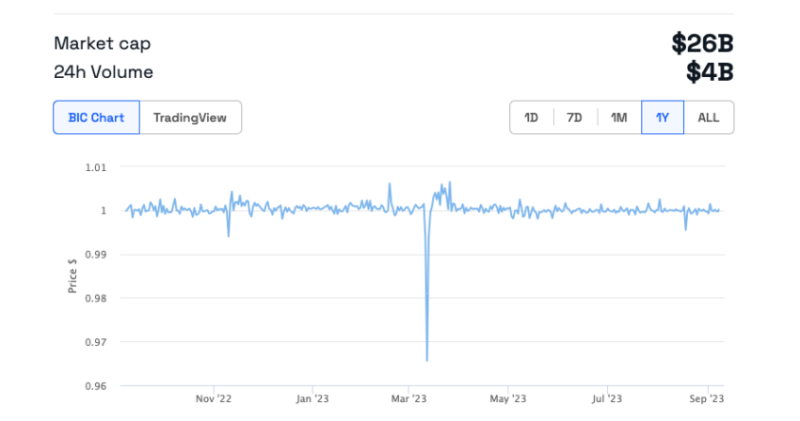

The agencies argue that even though stablecoins can usefully link the worlds of traditional and crypto finance, a loss of confidence in the reserves backing them can lead to a bank run. This, in turn, causes the asset to depeg from its fiat currency anchor.

USDC depegged from the US dollar in March | Source: BeInCrypto

To fix this, the FSB recommends clear lines of accountability and risk management for stablecoin issuers. Issuers must develop recovery plans to respond to a black swan event.

Non-Foreign Stablecoins Could Flip Instability Narrative

Speaking to BeInCrypto, Tranchess CEO Danny Chong said that unbeknownst to many, some countries are developing their stablecoins pegged to their own currencies. An example is the Singapore dollar-backed coin backed by new regulations proposed by the country’s monetary authority, and the potential for new euro-backed stablecoins when Europe’s Markets in Crypto-Assets (MiCA) bill goes into force next year.

Unlike existing stablecoins, an asset backed by the euro or Singapore dollar could fit into regulatory schemes prioritizing financial stability. According to the Monetary Authority of Singapore, its draft legislation will ensure stablecoins do not threaten the economy.

“When well-regulated to preserve such value stability, stablecoins can serve as a trusted medium of exchange to support innovation, including the ‘on-chain’ purchase and sale of digital assets.”

Chong added that traditional finance firms can still do certain things better than decentralized finance (DeFi). As a result, it is unlikely that cryptocurrencies will fully displace the systems people have grown accustomed to in the near term.

He also suggested that future developments in decentralized finance need to be shaped by regulations to progress. The absence of rules has resulted in notorious hacks and scams that have tarnished the reputation of DeFi.