To this day, privacy arguably remains the fatal flaw of the most popular blockchain networks.

Both Bitcoin and Ethereum use fully transparent public ledgers to store their transactions. While technically anonymous, careful digging can allow external parties – including governments – to uncover the identity of any number of parties behind an address or set of transactions.

For the more privacy-focused blockchains and protocols, authorities have mostly banned centralized exchanges from listing them or sanctioned them in the West, limiting onramps to crypto privacy-preserving technology. As such, a persistent problem for developers has been striking a balance between privacy tech and realistic adoption.

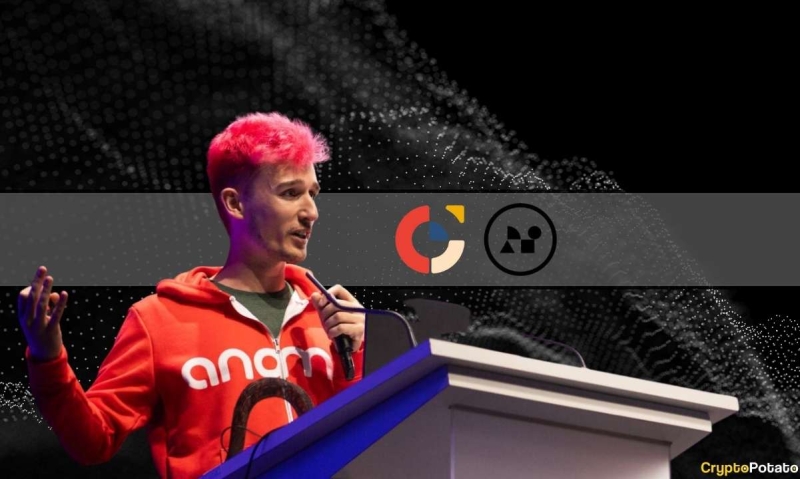

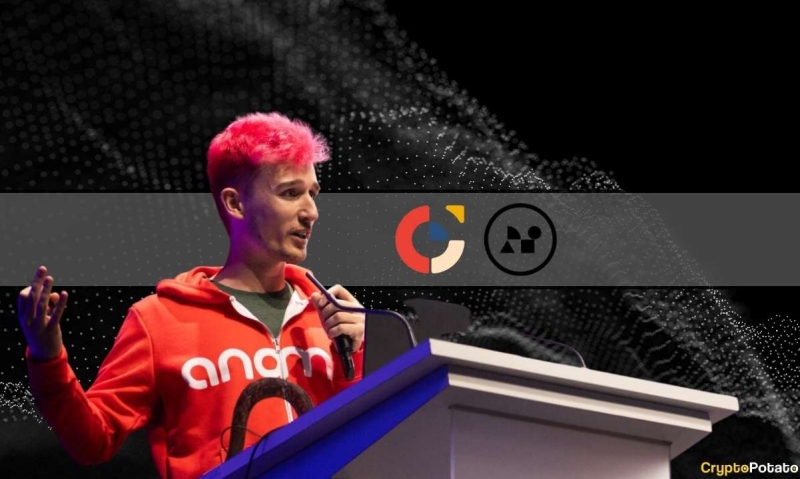

In conversation with CryptoPotato at EthCC Paris, Adrian Brink – co-founder of Anoma and Namada – explained how he and his team navigate these issues using both the Anoma protocol and Namada blockchain. During the interview, Brink digs into Anoma’s focus on “intent” centric blockchains, Namada’s use of “asset agnostic proof of stake,” and why Layer 2’s are, in fact, not the future of privacy and scaling.

Anoma and Namada in Simple Words

Namada is paving the way for a multi-chain privacy feature. In simple terms, it ensures privacy isn’t tied to a specific asset.

“Imagine you have a CryptoPunk that you want to move around. Right now, there’s no privacy solution for this, but with Namada, it inherits the privacy set from all daily USDT privacy transactions,” said Brink.

He emphasized the fundamental importance of privacy in the crypto space, noting:

“I think privacy is fundamental. If this space isn’t going to become private, the space goes away.”

At the same time, Anoma is the first intent-centric (blockchain) architecture, where intents are the most fundamental primitive. Anoma’s intent-centricity provides novel properties for applications, including end-to-end decentralization, information flow control (being able to specify who sees what), decentralized counterparty discovery, and configurable settlement (being able to decide your security domain for settlement.

Less security, higher throughput for things that don’t need financial level security), configurable ordering, and fully programmable intents.

Regulatory Compliance: Striking a Balance

When questioned about compliance with diverse global regulations, Brink reassured that Namada is fully regulatory compliant. He highlighted the flexibility it provides to users in revealing their data, based on their jurisdictional requirements.

“Users can decide what kind of information they want to reveal to whom,” Brink explained.

He emphasized that a universal standard for global regulations isn’t feasible, and the approach adopted by Zcash, from which Namada is an extension, is a testament to the importance of understanding and working with regulators.

Reflecting on his journey since 2016, Brink recalled his entry into the blockchain sphere, emphasizing his belief in a multichain system.

“I’m fundamentally a believer in the multichain. This is like there won’t be one chain to rule them all,” he shared.

Discussing the industry’s evolution, Brink noted that during market lows, there’s a focus on research, while during highs, the spotlight shifts to trends like NFTs.

ZK Tech: The Next Big Wave?

Addressing the challenges faced by privacy-oriented protocols, Brink asserted that the industry is still in its infancy when it comes to privacy tech. He believes that it will take another one to two years to see top-notch production quality in privacy solutions.

He encouraged a focus on regulatory education, emphasizing that privacy tech is not against governments but is a fundamental tool for national defense.

As for the future of Anoma and Namada, Brink revealed that Namada’s mainnet will launch soon, describing it as “the single best privacy solution in the space at the launch.”

Highlighting the industry’s future direction, Brink predicted that everything will become an L1, emphasizing the importance of intents for decentralized systems.

“There’s no way around intents and L1s. This is going to enable user flows that are just not possible right now,” Brink opined.

He ended on the note of ZK tech being the next big wave, with the first consumer applications revolving around censorship-resistant cash.