10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

Which pays more: a two-year Taiwanese government bond, or a prediction market contract about the potential invasion of Taiwan by China?

Turns out it’s the prediction market contract.

“No” shares on crypto-based platform Polymarket are trading at 92 cents, which means that should China not invade Taiwan by the end of the year, holders get an 8% return on their money.

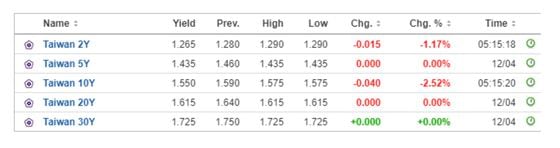

In comparison, a two-year bond from its central bank is paying just over 1.26%.

Government bonds have historically been a bet on the future prospects of a country.

Political instability, economic turmoil, and the possibility of war are hallmark characteristics of a developing nation. Investors demand to be rewarded for the risk, hence the higher yield on these bonds. El Salvador’s bonds have historically traded at a higher premium than a developed nation like Canada because the likelihood that catastrophe would strike the nation is considered to be much higher, but that trend is changing as its President’s bitcoin bet and war on organized crime appears to be paying off.

Taiwan’s government is fairly stable, and the country has a high degree of economic development, while also running a surplus. The market knows the government is regularly paying its debt, so there’s not much of a premium that can be commanded on the bond market.

Of course, an invasion would throw this into complete disarray. But such an event isn’t likely, based on how the bond market is pricing things. One might say that the prediction market is overpricing the potential for such an event, hence free money that yields more than the country’s own government bonds.

A word of caution and caveat: sometimes competitive Polymarket contracts get settled by how its oracle, Uma, interprets the fine print. The name Taiwan is often used as a synecdoche for the government of the Republic of China (ROC), which administers Taiwan, and roughly a dozen outlying islands, some of which, like Kinmen, are less than three kilometers away from the coast of the People’s Republic of China.

An invasion of Kinmen is an invasion of the ROC, but not an invasion of Taiwan—though for bettors playing the market, that’ll be up to Uma to decide.

Cooler heads

The flight of missiles and drones from Iran to Israel meant a panicked flight to safety for the crypto market this past weekend, as bitcoin dipped while tokenized versions of gold rallied.

This uptick in geopolitical tensions in the region didn’t appear to be long-term for the market, as crypto prices began their recovery as soon as rumors of the imminent approval of spot crypto ETFs in Hong Kong filtered through the market’s collective psyche.

Nor did it really shift the political landscape in a meaningful way for bettors on Polymarket.

A contract asking users to bet on the outcome of the 2024 Presidential election—which has over $110.8 million staked, easily a record for crypto-based prediction markets—saw “yes” shares for Biden winning rise 1 cent, to 45 cents, and “yes” shares for Trump dip by a penny to 45 cents. A share pays out $1 if the prediction turns out correct, so the market is signaling each candidate now has a 45% chance of winning.

While these aren’t really material moves, they’re at odds with some of the rhetoric on X (formerly Twitter), which, in its perpetually panicked state, thought a broader regional war was about to kick off.

In this regard, the market is reflecting some sober second thoughts. A contract predicting if Israel would retaliate against Iran with a counter-attack points to a 14% chance of it happening.

Edited by Marc Hochstein.