Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Multiple Hong Kong bitcoin exchange-traded fund (ETF) applicants, including China Asset Management, Bosera Capital and others, posted to social-media platform WeChat (Weixin) that they had been approved to list spot bitcoin and ether ETFs. However, these announcements seem to have front-run an official statement from the Securities and Futures Commission (SFC), which has not posted a list of approved issuers. Some of the posts have since been deleted. Singapore-based analytics company 10x Research said in a note there is a 100% probability that Hong Kong will not be the last jurisdiction to approve bitcoin ETFs, and more will likely follow. “This will be an additional demand driver for Bitcoin from various countries that could approve Spot ETFs, namely Australia, Japan, Korea, and the UK,” said the firm.

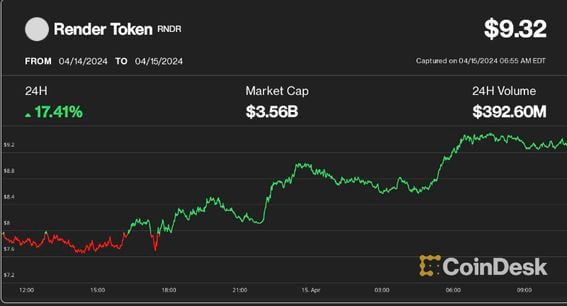

Bitcoin gained on Monday, adding 3% after dropping to as low as $61,300 over the weekend. The weekend’s drop was due to geopolitical tensions, according to some analysts. Matteo Greco, a research analyst at Fineqia, said: “The weekend’s price drop was attributed to geopolitical tensions in the Middle East, with market sentiment improving after an announcement regarding a temporary halt in hostilities among the involved nations.” He also noted that the upcoming bitcoin halving, could trigger a short-term “sell the news” reaction before and after the event. An array of altcoins also gained on Monday, with Render (RNDR), a GPU marketplace that lets users contribute computational power to 3D rendering projects and earn tokens in return, jumping 19%. Ondo Finance’s ONDO also gained, climbing 18% over the past 24 hours.

Germany’s largest state-backed lender, Landesbank Baden-Württemberg (LBBW), is set to offer crypto custody services through a partnership with Austrian exchange platform Bitpanda. The two firms have entered into a strategic partnership, which would see LBBW provided with “Investment-as-a-Service” infrastructure to “store and procure cryptocurrencies,” including bitcoin (BTC) and ether (ETH). “By offering crypto-asset custody, we are positioning ourselves with a clear added value for our corporate clients – while ensuring the highest security standards,” Stefanie Münz, member of the LBBW board of directors responsible for finance, strategy and operations, said in a press statement. “Bitpanda provides the necessary technical and regulatory infrastructure to offer our customers innovative and, above all, secure solutions in the area of digital assets.”

Chart of the Day

- The chart shows bitcoin’s 2% aggregated market depth, or combined value of buy and sell orders within a 2% price range of the market price, in BTC terms.

- The market depth has dropped to 6.76K BTC, the lowest in at least a year.

- Weak depth means the market may not absorb large buy/sell orders at stable prices.

- Source: Kaiko

Trending Posts

- UK to Issue New Crypto, Stablecoin Legislation by July, Minister Says

- Sticky Liquidity in DOGE and SHIB Suggests Meme Tokens Have Staying Power

- Bitcoin Halving Has Crypto Miners Racing for ‘Epic Sat’ Potentially Worth Millions