10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

- Some market participants alleged that Aevo’s volume was recently inflated by wash trading, with some pointing to recent activity in out-of-the-money ether options as evidence.

- Asked about the accusations, Aevo said the increased volume might be tied to “airdrop farming.”

- Wash trading, in which the same person acts as both buyer and seller on a trade to create a false sense of activity, is banned in conventional markets like stocks.

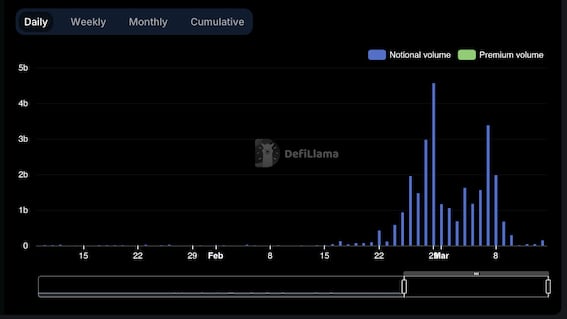

Daily trading volume on the decentralized crypto perpetual and options exchange Aevo recently surged from around $100 million to over $4.5 billion, only to fall back to square one in a flash.

The boom-bust volume pattern prompted several market participants to that the spike was due to wash trading, a type of market manipulation in which a trader repeatedly acts as both buyer and seller on the same transactions to create the false impression of increased activity.

Asked about the accusations, Aevo founder Julian Koh told CoinDesk: “Some users were pumping volumes to $1 billion +, to get more of our airdrop. But the snapshot was taken last week so it’s not happening anymore.”

Protocols including Blast, Ether.Fi and EigenLayer have seen their total value locked (TVL) soar lately as traders engage in something called airdrop farming – essentially parking money to get loyalty points that might get converted into potentially valuable tokens if the protocols issue them via an airdrop.

In conventional securities markets like stocks, wash trading is plainly against the rules. In crypto, there have been some regulatory crackdowns, too.

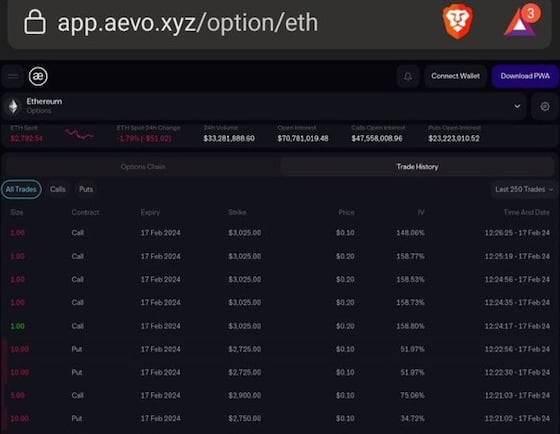

Explaining the wash trading allegations made on social media X, pseudonymous analyst and author of Alpha Made Here newsletter, , told CoinDesk that, “Out of nowhere, the exchange started doing the daily volume of nearly $5 billion, with someone trading a large number of same-day options at strikes way out of the money for as low as 10 cents.”

Call options give the purchaser the right, but not the obligation, to purchase the underlying asset at a predetermined price by later date. A call buyer is implicitly bullish on the market. The bet pays off only if the underlying asset rises above the strike price at which the call is bought on or before the expiry.

Data tracked by DeFilama shows that daily options volume on Aevo first crossed above the $100 million mark on Feb. 17 and rose as high as $4.56 billion on Feb. 29 before falling back to less than $50 million early this week.

On Feb. 17, while ether (ETH) traded between $2,720 and $2,820, someone traded out-of-the-money (OTM) $3,025 ETH call options on Aevo, according to data tracked by DeFi Made Here. The call option was set to expire on the same day.

The activity has raised suspicion, because traders typically buy out-of-the-money (OTM) calls in longer duration expiries than shorter ones. That’s because the probability of the bet paying off is directly correlated to the time to expiration.

Note that one option contract represents one bitcoin (BTC) or ether. So, a small amount of wash trading can generate a sizable notional volume in an upward-trending market.

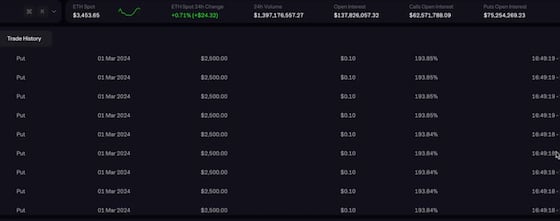

One DeFi options trader who asked to stay anonymous pointed to a similar unusually substantial activity in the $2,500 ETH put on Feb. 29, when ETH changed hands at $3,500. The put option was due to expire – likely worthless, since ETH was trading so far above the put’s strike price – on March 1.

DeFiLama’s pseudonymous builder, , on X recently echoed DeFi Made Here’s allegations, saying the volume spike was mostly wash trading as Aevo made a program that rewards volume for airdrop.

Early last month, Aevo announced a farming program to reward early adopters of the exchange with its recently debuted AEVO token. The program tracked trading volume, fees and loyalty, effectively tying farming to platform usage.

The program ended on March 13, when Aevo airdropped $95 million worth of AEVO tokens to users. On the same day, Aevo debuted on the biggest cryptocurrency exchange, Binance, with a new launch pool, where the token can be farmed by staking BNB and FDUSD.

Edited by Aoyon Ashraf and Nick Baker.