10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

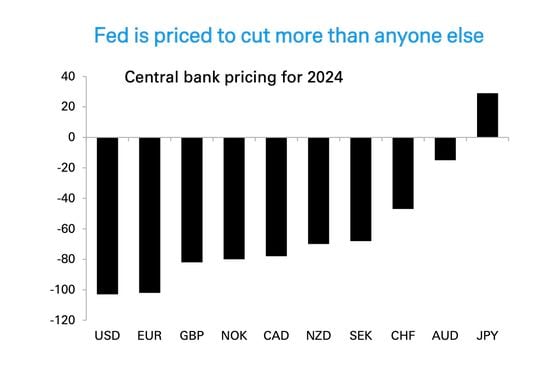

- The Fed is expected to cut rates by 100 basis points next year, becoming the most dovish among advanced nations’ central banks.

- The stance will probably weigh on the dollar. A weaker greenback often incentivizes risk-taking in crypto and traditional markets.

If there is one thing that both crypto and traditional markets love unconditionally, it is cheap fiat liquidity. The U.S. Federal Reserve, the world’s most powerful central bank, is likely to take steps in that direction next year.

The Fed is priced to be the most dovish among advanced nation central banks in 2024, with traders anticipating at least 100 basis points – or 1 percentage point – of interest-rate cuts from the current 5.25% to 5.5% range, according to Deutsche Bank Research. That will dent the U.S. dollar’s appeal as a relatively high-yielding asset.

According to ING, the U.S. economy and the inflation rate are expected to slow next year, allowing the Fed to pursue a looser monetary policy.

Bank of America, in its Nov. 19 World at Glance report, said the tide is turning for the greenback and “it can start to adjust broadly lower towards equilibrium” next year.

“While we still envision the U.S. performing relatively well next year vis-à-vis other major economies, the prospect of an eventual economic landing and corresponding Fed easing, even alongside easing elsewhere, should provide broad relief to currencies across the globe,” Bank of America’s strategists said.

A weaker dollar often becomes a tailwind to risk assets, including bitcoin, as occurred in the second half of 2020 and early 2021. The greenback is a global reserve currency, playing an outsized role in global trade and non-bank borrowing. When the dollar strengthens, it causes financial tightening worldwide, disincentivizing risk-taking. The opposite is true when it weakens.

The chart shows that most advanced national central banks, led by the Fed, are expected to cut rates next year, having lifted them rapidly in the past 18-20 months to tame inflation.

The coordinated easing could compensate for potential rate hikes by the Bank of Japan, which has been touted as a significant source of uncertainty for crypto and traditional markets. The Japanese central bank has been slowly moving away from its ultra-easy monetary policy this year, although its benchmark rate remains below zero.

Note that heightened expectations for easing mean there’s scope for disappointment and a sharp dollar rally should inflation rebound.

“There are several ‘known unknown’ scenarios that in aggregate imply a notable risk to our base-case of weak USD,” Bank of America’s strategists said. “We identify an upside growth/inflation driven rate shock originating in the U.S., a supply-driven upward oil price shock, and a downward growth shock from China as the most visible among them.”

Edited by Sheldon Reback.