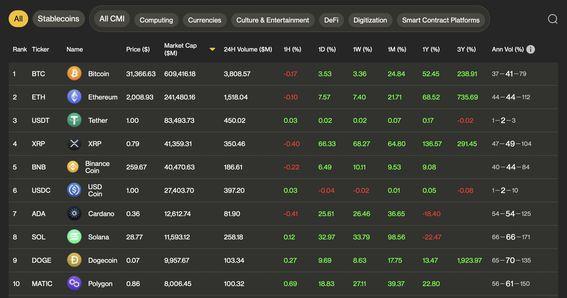

Payments-focused cryptocurrency XRP has surpassed BNB token to become the world’s four-largest digital asset by market cap.

As of writing, XRP boasted a market cap of $41.44 billion, with the tally surging 66% in the past 24 hours alone, according to CoinDesk data. While BNB’s market value rose 6.5% to $40.57 billion. XRP’s price surged from 47 cents to nearly 78 cents.

Ripple Lab’s partial victory in a long, drawn-out legal battle with the U.S. Securities and Exchange Commission (SEC) over the sale of XRP has powered the cryptocurrency’s surge.

On Thursday, the District Court for the Southern District of New York said Ripple’s offer and sale of XRP on digital asset exchanges did not amount to offers and sales of investment contracts as alleged by the SEC.

The Court, however, said that Ripple’s direct sale of XRP worth over $700 million to institutions, hedge funds and other parties violated securities laws. The SEC, in late 2020, filed a lawsuit against Ripple for selling unregistered securities after the company sold $1.3 billion worth of XRP. The regulatory action kept saw several exchanges delist XRP and kept the cryptocurrency under pressure while the broader market ended that year on a high note.

The first part of the ruling has opened doors for a renewed listing of XRP by centralized exchanges. has already taken the step and is exploring the listing of XRP for both spot and derivatives trading.

Meanwhile, the second part of the ruling has determined that XRP is a security, according to CoinShares’ Head of Product, Townsend Lansing.

“The Court has found Ripple to be in violation of securities laws, specifically in relation to direct sales to institutional investors. As such, XRP is not only deemed a security, but questions have arisen regarding the legality of its offering. In regards to these sales, the Court has confirmed that the law was indeed violated, marking a considerable victory for the Securities and Exchange Commission (SEC) and setting a precedent for its legal actions against other cryptocurrencies,” Langsing said in an email.

“It is important to note that institutional investors who purchased directly from Ripple may find themselves subject to class-action litigation as potential underwriters. This is an area to watch closely, especially if big-name venture capitalists were involved,” Langsing added.

Traders have yet to focus on the second part of the ruling, as evident from the price surge and the bullish positioning in the perpetual futures market.

Perpetual futures are like standard futures contracts with no expiry or settlement date.

Data from Coinglass show aggregated volume-weighted perpetual futures funding rates worldwide have jumped to the highest since at least December. The open interest-weighted rates have risen to a four-month high.

Both suggest the leverage is decisively skewed to the bullish side.

Funding rates are periodic payments of an asset between bullish long and bearish short position holders in the perpetual futures market. A positive funding rate means longs are dominant and are paying shorts to keep their positions open.

Edited by Parikshit Mishra.