The weekly time frame chart for Maker coin price highlights a key shift in market dynamics. After a prolonged downtrend starting in May 2021 that saw the price hit a low around the $500 level, the asset entered a sideways trend in June 2022. This prolonged accumulation phase typically precedes a fresh bullish trend, suggesting a more optimistic future for the MKR price.

Also Read: Maker Price Rally Rages On As Active Addresses Hit 10-Week High

Will MKR Price Rise Back to $1800?

- The MKR coin price may face supply around the $1668 level

- A breakdown below $1610 support sets a potential fall to $1500

- The intraday trading volume in MKRer is $1.9 Billion, indicating a 33% loss

Source- Tradingview

The Maker coin price has been on a recovery trajectory since June 2023 as the price rebounded from the support zone around $500. In the last 4 months, the coin price registered 185% to reach the current trading price of $1458. amid the ongoing recovery, the coin buyers have recently breached the horizontal resistance zone of $1355 to $1300.

A bullish breakout from this multi-month resistance should offer buyers a significant footing to bolster their further rally. However, with an intraday loss of 3.31%, the maker coin shows a minor pullback to retest the breach level. If the coin price shows sustainability above the e $1,355 mark, the buyers would get a strong foothold to prolong the recovery trend.

The post-breakout rally may push the coin price another 15% to reach $1668.

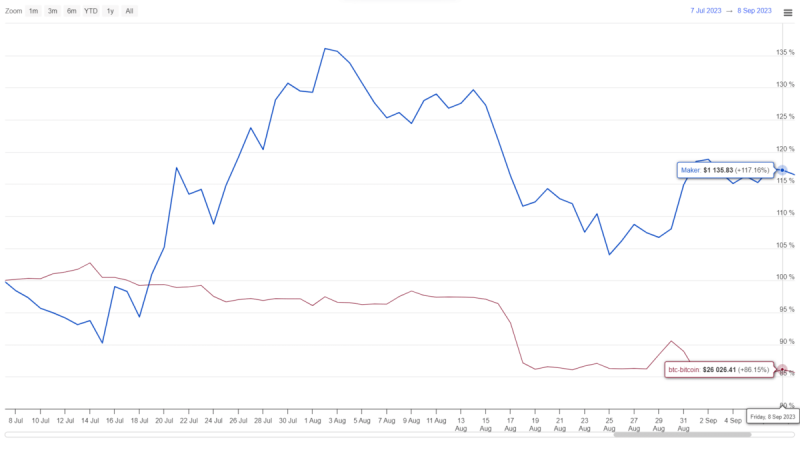

MKR vs BTC Performance

Source: Coingape| Maker Vs Bitcoin Price

The last three months’ price action clearly defines the Maker coin outperformed Bitcoin price with its parabolic growth. While the MKR price shows a set of new higher highs and lows reflecting an established recovery, the BTC price shows an evident sideways trend.

Thus, this altcoin can be an interesting opportunity to buy if the bullish momentum persists,

- Exponential Moving Average: The coin price moving higher to Daily EMAs(20, 50, 100, and 200) accentuates a steady recovery trend.

- Relative Strength Index: The daily RSI slope rising high above the 60% mark reflects a high momentum rally.