For over a month, the second largest cryptocurrency Ethereum(ETH) has been trading sideways resonating between two horizontal levels of $2140 and $2400. Despite a heavy sell-off on January 4th, the ETH price showcased its sustainability above the $2140 support which is above the safety net of 38.2% Fibonacci retracement level. The combined support could offer buyers an opportunity to revive the exhausted bullish momentum and extend the recovery trend.

Will Market Correction Push Ethereum Price Below $2000

- A bullish breakout from $2400 will release the buildup of bullish momentum

- A confluence of several technical levels creates strong support at $2140

- The intraday trading volume in Ether is $10.2 Billion, indicating a 45% gain.

Ethereum Price| TradingView Chart

Amid the increasing uncertainty in the crypto market, the Ethereum price witnessed another reversal from the $2400 resistance. In the last five days, the coin price plunged 7.5% to currently trade at $2247.

The buyers are obtaining suitable support at the combined support of $2140 and 38.2% Fibonacci retracement level. Such a degree of correction indicates the buyers continue to have an upper hand over this asset which may result in a stronger bounce back.

Moreover, the U.S. Securities and Exchange Commission (SEC) is showing signs of moving closer to the approval of the first spot Bitcoin exchange-traded funds (ETFs) in the United States. This progress is marked by the submission of amended 19b-4 filings by exchanges that are expected to list these ETFs.

With a high possibility of spot Bitcoin approval next week, the newcomers can look for bullish reversal opportunities at $2140 support. A potential bounce back from this support could push the coin price 7% to challenge $2400, whose breakout will better confirm an uptrend continuation.

The post-breakout rally could surge the ETH price to $2675 and higher.

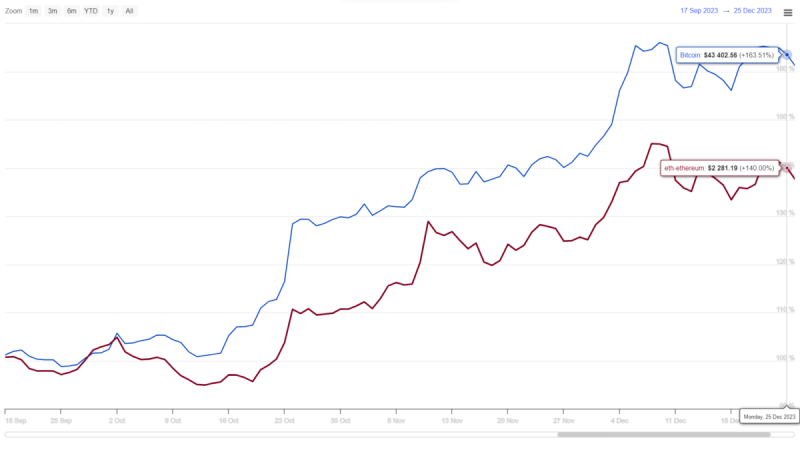

BTC vs ETH Performance

Source: Coingape| Bitcoin Vs Ethereum Price

In recent market trends, Bitcoin and Ethereum have both shown a pattern of gradual recovery with higher highs and lows. However, the ETH price has somewhat underperformed, evidenced by the formation of a new lower high in its price trajectory. The anticipated approval of a spot Bitcoin ETF is expected to provide a significant boost to Bitcoin’s market sentiment, potentially increasing its appeal to a broader range of investors and strengthening its market position.

- Exponential Moving Average (EMA): The 20-and-50-day EMA continues to act as dynamic support to ETH price

- Moving Average Convergence Divergence: A bearish crossover state MACD(blue) and signal(orange) reflect a correction mode that is active

Related Article:

- Ethereum Price Slips As Paradigm Dumps 6,500 ETH To Coinbase, What’s Happening?

- Ethereum (ETH) Metrics Hints Readiness for Huge Gains, Is $2500 Possible?

- Ethereum Price Prediction: Buterin’s 2024 Roadmap Sparks Rally to $5,000