10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

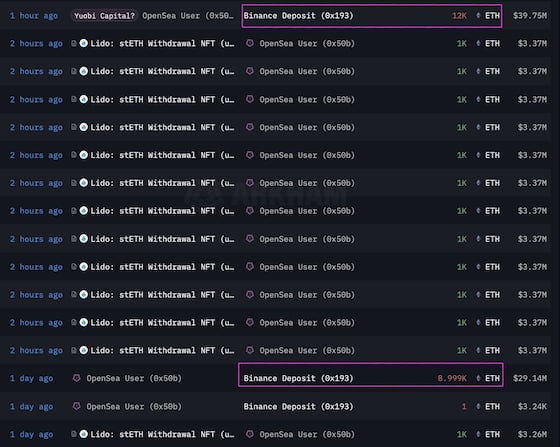

- A crypto whale transferred 12,000 ETH to Binance on Wednesday, according to Lookonchain.

- Ether rose 11% on Wednesday despite regulatory concerns.

- The options market remains more bearish on ether than bitcoin.

An investor holding a large amount of ether (ETH), a so-called whale, who began trading the Ethereum blockchain’s native token in 2017 moved a large chunk of it to crypto exchange Binance on Wednesday, in a possible precursor to liquidating the holding.

Roughly 18 hours ago, the address x50b42514389F25E1f471C8F03f6f5954df0204b0 transferred 12,000 ETH (worth $42.8 million at the time) to Binance, according to blockchain sleuth Lookonchain. That’s about 0.01% of the total circulating supply of the second-largest cryptocurrency by market cap. The same address moved nearly 9,000 ETH to Binance on Tuesday, withdrawing 30 million tether (USDT). Tether is the world’s largest dollar-pegged cryptocurrency.

“A giant whale deposited 12K ETH to Binance 1 hour ago and may sell it,” Lookonchain during Wednesday’s U.S. trading hours.

Moving coins into addresses tied to cryptocurrency exchanges often indicates an intention to sell or deploy coins as a margin in derivatives trading. Thus, a large inflow of coins frequently presages increased price volatility.

It’s possible the whale was looking to sell the cryptocurrency on the rise. Ether rose 11% to $3,500 on Wednesday, reversing a Tuesday slide. At press time, it was trading at $3,535, according to CoinDesk data.

The rally occurred even after reports emerged that the U.S. Securities and Exchange Commission is seeking to classify ETH as a security, a move that would derail plans for listing spot ether exchange-traded funds in the country and subject ETH and projects interacting with Ethereum to more stringent regulation.

Still, data from Deribit’s options market shows traders are more bearish on ether than bitcoin (BTC). While ether’s one-week put options trade at a 4% premium to its calls, bitcoin’s puts trade at a 2% premium. A similar dynamic is observed in options expiring in one month, according to data tracked by Amberdata.

A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A put buyer is implicitly bearish on the market, looking to profit from or hedge against an impending price drop.

Edited by Sheldon Reback.