As the Mt. Gox October repayment deadline approaches, crypto observers expect a major industry event this fall.

While the cryptocurrency community is actively discussing the upcoming Bitcoin halving in 2024, another potentially big market event is happening this year.

The trustee of the hacked Bitcoin (BTC) exchange, Mt. Gox, is set to finally repay the exchange’s creditors by the end of October 2023. If that happens, the cryptocurrency market could be significantly affected in several ways, some industry observers agree.

Founded in 2010, Mt. Gox was once the biggest Bitcoin exchange in the world, estimated to facilitate around 70% of all BTC transactions before its implosion.

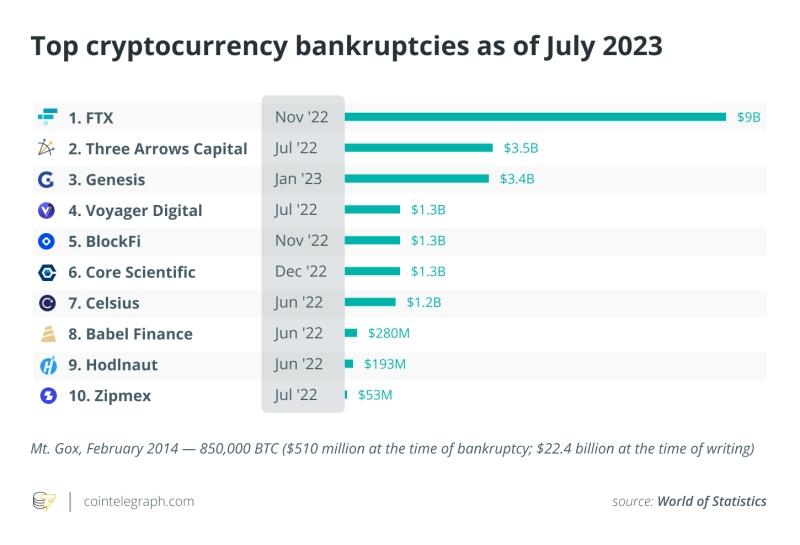

The now-defunct exchange lost 850,000 BTC — 4% of all Bitcoin to be issued — in a security breach in 2014. The event made Mt. Gox one of the biggest cryptocurrency bankruptcies of all time, with creditors yet to be repaid nine years later.

As the current Mt. Gox repayment deadline is scheduled to occur in roughly three months, Cointelegraph has reached out to some crypto executives to find out what to expect from the anticipated Mt. Gox repayment.

What will the investors do once they get their Bitcoin back?

The repayment of Mt. Gox will be a unique event, which is certain to have a significant impact on the market, WhaleWire founder and CEO Jacob King believes.

After losing all their Bitcoin almost 10 years ago, most creditors are likely to sell at least part of their BTC once they finally get it back, King told Cointelegraph.

“This influx of sell orders could create a downward pressure on prices and potentially lead to a market downturn,” he said. King also mentioned multiple prolonged delays in the Mt. Gox repayment process, which has already caused a sense of “disillusionment among investors, eroding their confidence in the market.”

The WhaleWire CEO continued:

Total current balance on all known addresses* of the MtGox Trustee: 135890.98002134 BTC.

-0.00043187 BTC have been moved away from these addresses since 2018/05/10. $BTC #bitcoin #mtgox mt.gox mt gox

2023-07-11T09:19:03.239Z UTC

— MtGoxBalanceBot (@MtGoxBalanceBot) July 11, 2023

Mt. Gox Bitcoin repayment amount is close to Michael Saylor’s BTC holdings

While many crypto enthusiasts believe that Mt. Gox repayment will be a massive event, some skeptics are confident that any potential effects will likely subside quickly.

The amount of Bitcoin that is to be handed back to Mt. Gox creditors is comparable to the holdings of Bitcoin advocate Michael Saylor, who holds at least 152,333 BTC ($4.52 billion).

“Either way, it doesn’t seem like a lot,” Quantum Economics founder Mati Greenspan told Cointelegraph. Referring to the current worth of Bitcoin to be repaid, Greenspan emphasized that the current daily on-chain volumes are much bigger.

“Daily on-chain volumes are at an average of $12 billion, exchange volumes are reportedly in the neighborhood of $18 billion per day,” he noted, adding:

“So this is certainly something the market can absorb in a relatively short time frame. I would assume there may be some sell pressure due to the speculation around this event. Many people don’t know basic math.”

Greenspan also stressed that Mt. Gox’s Bitcoin will be distributed to lots of people, which could be very good for the network as a “mass-distribution event.”

“That’s a lot of OGs that will be reactivated. Some of them will sell and wash their hands, but I bet many will be staunch advocates of self-custody,” he added.

The exec also expressed optimism about the potential repayment, stating that Mt. Gox-related FUD has been “plaguing the market” for many years, and it will be “good to see it finally put to bed.”