The former executive will help Circle maintain USDC’s 1:1 peg to the US dollar and oversee regulatory compliance.

Circle’s Risk Director Joins Former CFTC Exec

Broderick will leverage his three decades advising Wall Street firms on risk management at Circle. While at Goldman Sachs, he supervised the company’s credit, market, liquidity, operational, model, counterparty, and insurance risks.

He is also the president of the Bank of Montreal’s Risk Review Committee and is on a board of organizations empowering urban youth.

Broderick said in a Circle press statement announcing his appointment:

“The digital currency landscape is evolving rapidly and will clearly play an important role in the global financial landscape in the coming years.

Circle is exceptionally well-positioned to lead developments in this field, and I’m excited to help the firm realize its potential.”

The former executive arrived after the United States Securities and Exchange Commission (SEC) sued industry heavyweights Binance and Coinbase. While Circle is not directly affected by the SEC lawsuits, it held 8% of cash reserves backing its stablecoin at Silicon Valley Bank, which failed a liquidity stress test earlier this year.

Circle’s CEO Jeremy Allaire said of the appointment,

Strong risk management is essential to Circle’s efforts to make USDC the safest, most trusted, and transparent digital dollar on the internet.

Craig’s deep knowledge and experience as the long-time risk management leader for one of the world’s largest and most successful financial institutions will be an important asset as we continue advancing our regulatory-first business approach.”

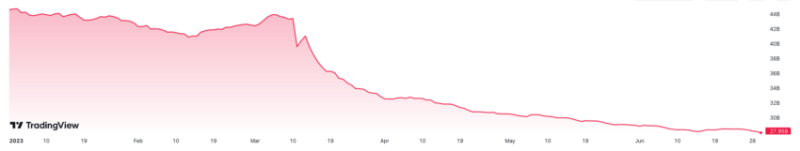

USDC Lost Significant Market Cap Since 2023 | Source: TradingView

Broderick joins the former president of the Commodity Futures Trading Commission, Heath Tarbert, who Circle previously hired as legal director.

Not sure what a stablecoin is? Read our handy guide here.

Goldman Sachs Bullish on Bitcoin

Investment bank Goldman Sachs viewed Bitcoin favorably during Broderick’s tenure.

At the start of this year, the bank called Bitcoin 2023’s most profitable asset. The company said that Bitcoin has outperformed traditional market instruments like the S&P 500, gold, oil, real estate, and the Nasdaq-100.

Goldman Sachs said it supports blockchain technology and is developing its blockchain for tokenized asset transfers. According to Matthew McDermott, the bank’s director of digital assets, the company supports the blockchain and hopes to hire more staff.