Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Ether, the second-largest cryptocurrency by market value, reached levels not seen for almost two years on Monday as investors anticipated approval of spot ether exchange-traded-funds (ETFs) in the U.S. Ether (ETH) climbed to $2,984 yesterday, the highest level since April 26, 2022, according to data from TradingView. Ether is now hovering around $2,933. In the short term, analysts expect ETH to move higher, possibly reaching $3,600. “We are very close in this move to levels around $3,150-$3,300,” said Kenny Hearn, SwissOne Capital’s chief investment officer. “The next level after that would be $3,600 and we think this is quite easily attainable in the next month or so as the alts continue to play catch up.” Bitcoin, the largest cryptocurrency by market capitalization, was little changed on Tuesday. Altcoins gaining included Filecoin’s FIL, which climbed 17%, and Hedera’s HBAR, which added 8%.

Ethereum rollup Starknet initiated the distribution of 728 million tokens to around 1.3 million addresses in what is being dubbed the largest airdrop of the year. Starknet token’s STRK pre-launch perpetual futures were trading at $1.80 on decentralized futures platform Aevo. The token traded as high as $5 on Kucoin minutes after it was released and has since slumped to $3.50 in a volatile opening. With an initial total supply of 10 billion tokens, the fully diluted value (FDV), the theoretical market capitalization if the entirety of its supply were in circulation, stands at $35 billion. The actual market cap, which is the current circulating supply multiplied by the current price, is at $2.32 billion.

Demand for bitcoin (BTC) exchange-traded funds accelerated again last week as they raked in a record $2.4 billion of the $2.45 billion that flowed into digital asset investment products, crypto asset management firm CoinShares said Monday. Allocations to the newly approved U.S.-based spot bitcoin ETFs overwhelmed the $623 million outflows from Grayscale’s Bitcoin Trust (GBTC), the incumbent fund that converted into an ETF structure. BlackRock’s IBIT and Fidelity’s FBTC attracted $1.6 billion and $648 million over the past week, respectively. “This represents a significant acceleration of net inflows, distributed widely among various providers, indicating an increasing interest in spot-based ETFs,” said James Butterfill, CoinShares’ head of research.

Chart of the Day

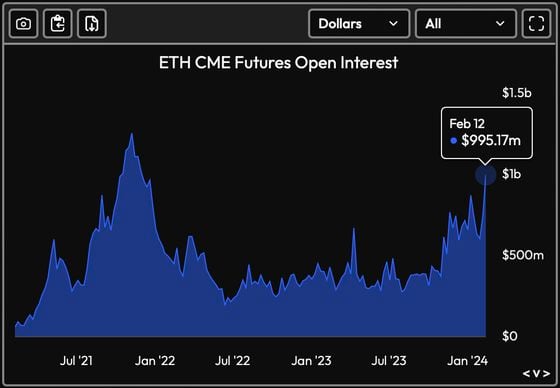

- The chart shows notional open interest or the dollar value of the number of active ether futures contracts on the CME.

- Open interest is fast closing on the $1 billion mark for the first time since late 2021, indicating renewed investor interest in trading ether.

- Source: Velo Data

– Omkar Godbole

Trending Posts

- UK Minister Expects Stablecoin and Staking Legislation Within Six Months: Bloomberg

- DeFi Platform Earning Yield by Shorting Ether Attracts $300M

- Swiss Crypto Hedge Fund Tyr Capital Clashes With Client Over FTX Exposure: FT

Edited by Sheldon Reback.