“5 million daily crypto users today, is likely to be 100 million in less than 5 years,” he noted.

Blockchain Forges Its Unique Path

Coutts asserts that blockchain adoption rates remain consistently high, regardless of the prevailing market cycle in the crypto space, be it a bull or bear market.

“Bear market/bull market adoption of blockchain technology continues unabated. Not having exposure to one of the largest structural trends of the next decade could be costly.”

Meanwhile, a recent PwC report emphasized the growing importance of blockchain technology in addressing the expanding issue of financial inclusion.

The report underlines the urgency of adopting blockchain on a broader scale to combat this issue.

Major Financial Institutions’ Blockchain Challenges

PwC’s statistics reveal the increasing challenge of limited access to traditional banks and the ability to save money for a significant portion of the global population, making it more imperative than ever to embrace blockchain technology at a larger scale.

Recently, Sergey Nazarov, Chainlink co-founder, highlighted the obstacles currently facing banks in their efforts to adopt blockchain technology.

Nazarov pointed out that the substantial financial and temporal investments made by banks worldwide in the traditional SWIFT payment system will make it challenging for them to transition away from it.

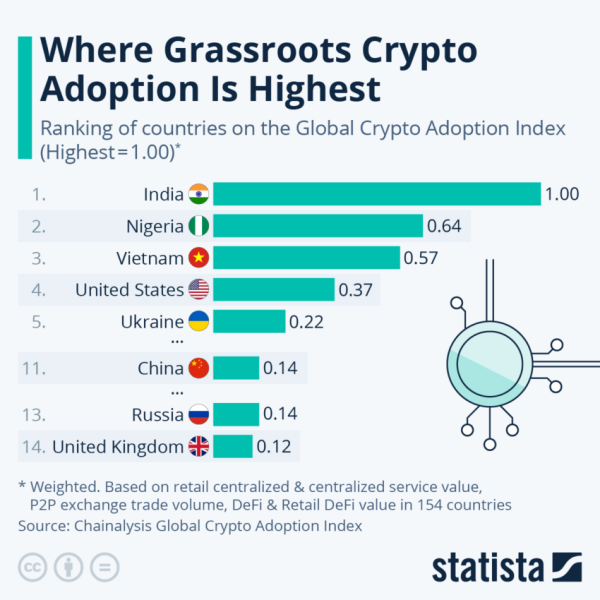

Conversely, the leading hotspots for global crypto adoption aren’t necessarily the most obvious choices.

Grassroots global crypto adoption by country. Source: Statista

India holds the number one position on the global crypto adoption index, with Vietnam, the Philippines, Ukraine, and Kenya closely following suit.

Top crypto platforms in the US | November 2023

Paybis No fees for 1st swap →

iTrustCapital Crypto IRA →

Coinbase $200 for sign up →

Uphold No withdrawal fee →

eToro $10 for first deposit →

BYDFi No KYC trading →