On Aug. 10, Ethereum advocate Ryan Sean Adams observed that the Worldcoin ecosystem could drive corporate demand for Ethereum.

Worldcoin Guzzling The Gas

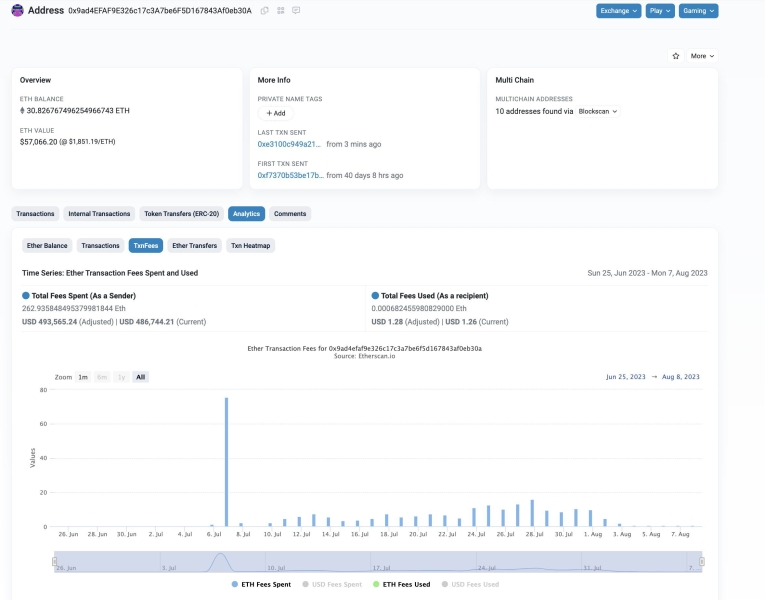

He reported that the Worldcoin authority that submits zero-knowledge proofs of retina scans had already spent $500,000 in gas over the past 40 days.

If the trend continues, this could result in $4.5 million in annual gas fees, he said before adding:

“Companies will need to hoard ETH the same way they hoard other essential commodities. Ethereum blockspace is the new oil.”

Worldcoin Authority Gas Usage. Source: X/@RyanSAdams

Others commented that Ethereum’s blockspace is like digital real estate.

As more businesses build on the network, the space becomes a hot commodity, driven by supply and demand, they said before adding:

“Just as companies stockpile traditional resources, Ethereum is emerging as a must-have asset in the new digital age.”

When the Worldcoin orb verifies a user is a unique human, their identity (World ID) is added to a public list of verified humans. The World app generates a zk-proof that verifies the information whenever the user wants to prove their identity.

A zk-proof is a cryptographic protocol whereby one party can prove to another party that a given statement is true without revealing any additional information about that statement.

Stay vigilant of your privacy and learn how to transact discreetly using cryptocurrencies: How do Privacy Coins Work?

Developer “@DCbuild3r” explained that the World ID identity manager contract is submitting the proofs. He said,

“The biggest cost here are insertions and not zk-proof verifications which are mostly happening on Optimism.”

He added that once Worldcoin moves to using “storage proofs,” insertion costs will be roughly half. Storage proofs are a cryptographic method of tracking blockchain information so that it can be shared across different chains.

Worldcoin has caused a lot of controversy in the crypto industry over privacy concerns and dubious tokenomics.

ETH Price Outlook

A similar pro-Ethereum narrative was suggested after PayPal announced its new stablecoin which will be an ERC-20 token. In addition to Ethereum blockspace potentially becoming ‘digital oil,’ it is also becoming the monetary layer of the internet, commented RSA.

However, Ethereum prices have not reflected any of these narratives and have been sideways for months.

ETH was trading flat on the day at $1,851 at the time of writing.

ETH Price Chart USD 7 Days. Source: BeInCrypto

The asset has been hovering around this price level since mid-June, when it recovered from a brief dip to $1,640 following the slew of SEC lawsuits.