Chainlink Price Prediction: On October 21st, the Chainlink coin escaped a 16-month accumulation phase, breaking through the resistance trendline of a channel pattern. This led to a rally that catapulted the coin from $8.1 to $12, registering a stunning 47% gain. However, amid prevailing market uncertainty—largely fueled by the Bitcoin price sideways movement—LINK price is grappling with a robust supply barrier at the $12 level. is the recovery phase over?

Also Read: Chainlink Price Shoots 6% With Ascending Triangle Breakout, Next LINK Target At $15?

Overhead Selling Hints Upcoming Pullback

- The 5% drop today reflects the initiation of a new correction in LINK price.

- The $9.5 level would stand as strong support amid anticipated pullback.

- The intraday trading volume in the LINK coin is $1.2 Billion, indicating a 1.2% gain.

Source- Tradingview

Caught in the current market uncertainty, the Chainlink price recovery hit a major roadblock at the $12 resistance point. Despite multiple attempts by buyers to breach this level over the past week, each effort has been thwarted, leading to a series of rejection candles.

This suggests that LINK price may undergo a short-term correction to gather steam for its next bullish run. Given the altcoin’s impressive late-October performance, a minor pullback could offer a healthy reset for buyers.

According to the Fibonacci retracement tool, the potential support zones lie at $10.5 (23.6% FIB), $9.5 (38.2% FIB), and $8.8 (50% FIB), which could provide the necessary footing for a resurgence in bullish momentum. Based on the original channel pattern, this altcoin price is positioned to aim for a $12.6 target, representing a 15.22% uptick from its current price.

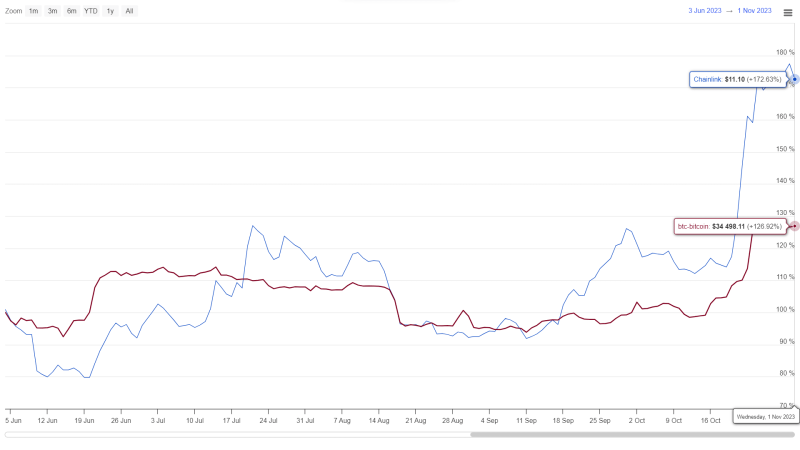

LINK vs BTC Performance

Source: Coingape| Chainlink Vs Bitcoin Price

A review of the past six months’ price behavior reveals Chainlink coin is outpacing Bitcoin in performance. While Bitcoin largely meandered sideways for much of the year before recently gaining some momentum, the LINK price recovery trend has grown increasingly assertive, making it an attractive option for momentum traders.

- Average Directional Index: The ADX slope at 50% suggests the current recovery phase could be nearing exhaustion.

- Vortex Indicator: The VI+ (blue) and VI- (pink) slopes converge signaling a potential bearish crossover further indicating the likelihood of a near-term pullback.