Bitcoin has been primarily choppy since our previous article. As a result, not much has changed in our stance, and we continue to pay close attention to the resistance at $28,000. A failure of the price to retake this level and hold above it will be bearish. Contrarily, a breakout above $28,000 will raise our suspicion. Besides that, there is one more thing we want to point out: the growing number of Bitcoin addresses with balances exceeding 1,000 BTC (which is bullish; however, the growth has not been too immense so far). We will update thoughts on the asset with the emergence of new developments.

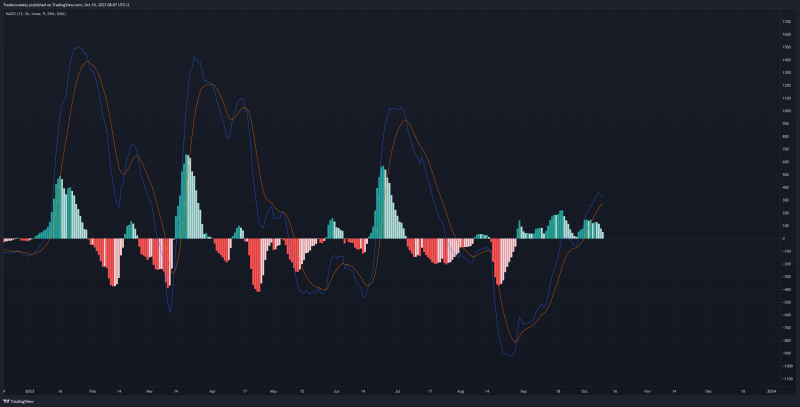

Illustration 1.01

Illustration 1.01 shows the daily chart of MACD, which is in the bullish area. However, if the price continues to trend sideways for a while longer, we will likely see MACD flattening.

Illustration 1.02

Illustration 1.02 displays the daily chart of Bitcoin dominance, which has been growing in line with our recent prediction.

Technical analysis gauge

Daily time frame = Bullish

Weekly time frame = Neutral

*The gauge does not necessarily indicate where the market will head. Instead, it reflects the constellation of RSI, MACD, Stochastic, DM+-, ADX, and moving averages.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.