10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

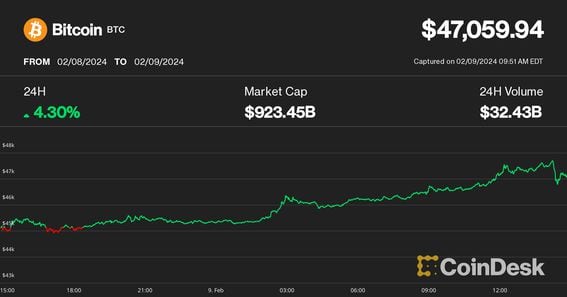

- Bitcoin jumped to $47,600 Friday U.S. morning hours, then quickly sold off 2%.

- Spot bitcoin ETFs saw over $400 million in inflows Thursday, their best day since Jan. 17, BitMex Research data shows.

Bitcoin (BTC) climbed past $47,000 Friday as U.S.-based spot bitcoin exchange-traded funds (ETFs) booked one of their largest net inflows Thursday since their debut.

The largest crypto by market capitalization ran to as high as $47,699, the highest since the bitcoin ETF launch day, before it buckled to $46,700 in a swift sell-off. Soon after, prices quickly rebounded slightly over $47,000. At press time, BTC was up 4.5% over the past 24 hours, outperforming the CoinDesk 20 Index (CD20), a measure of the biggest cryptocurrencies, which advanced 3.8%.

The price surge happened as spot ETFs increased their net bitcoin holdings by 9,260 BTC, according to CoinDesk calculation based on the issuers’ website. That translated to over $400 million in inflows, according to BitMex Research , the highest figure since January 17.

“This is the 3rd biggest inflow day for the group since their launch,” James Seyffart, ETF analyst at Bloomberg Intelligence, said in an X post. “Still a big day.”

While bitcoin gained nearly 10% in a week, the rally still has room to run, analysts said.

Alex Kuptsikevich, FxPro senior market analyst, told CoinDesk in an email interview that bitcoin is poised for higher prices for bitcoin after reclaiming the key 50-day moving average.

10X Research’s Markus Thielen said earlier this week that bitcoin targets $48,000 in the short-term fueled by strong historic gains around the Chinese New Year festivities. In the mid-term he forecasted BTC to reach $52,000 in March completing the fifth wave of its uptrend.

Edited by Sheldon Reback.