The Bitcoin Cash price appears to have hit a wall at $245, while other majors like Bitcoin (BTC) and Solana (SOL) have raced to new 2023 peaks. Can the bulls withstand the incoming bearish pressure?

BCH Network Activity Enters a Decline Amid Crypto Market Recovery

Bitcoin Cash appears to be struggling to break new ground amid the ongoing crypto market rally. On-chain data trends have now pinpointed a decline in network activity as one of the main reasons BCH price action has slowed down significantly this week.

The Bitcoin Cash peer-to-peer network has recently witnessed a noticeable drop in the number of active users, according to IntoTheBlock.

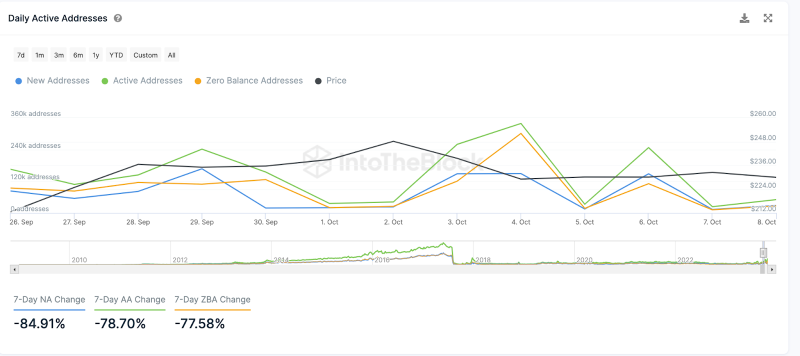

The chart below illustrates that BCH Active Addresses are down by 79% over the last seven days. Likewise, the number of new users joining the network has dipped by a staggering 85% during that period.

Bitcoin Cash Network Demand Stats vs. Price | Source: IntoTheBlock

The Active Addresses and New Addresses metrics are vital on-chain data points that provide a snapshot of economic activity being conducted on a blockchain network.

Active Addresses track the number of existing users carrying out viable transactions. Meanwhile, the New Addresses metric measures the rate at which the network attracts new entrants.

When both metrics decline simultaneously, it is a tell-tale bearish signal that the underlying BCH coin could witness less market demand in the coming days. Going by this thesis, Bitcoin Cash holders can anticipate more downside in the days ahead amid the market recovery.

Read More: 6 Best Copy Trading Platforms in 2023

Fees Generated on the BCH Network Decline

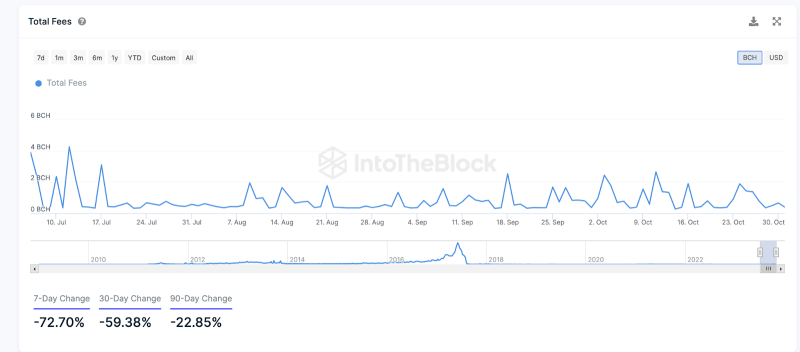

The current downtrend in BCH Total Fees generated daily is another relevant metric that confirms the decline in network activity.

The chart below illustrates that the Fees generated from transactions on the Bitcoin Cash network have declined 73% in the past week.

This worrying trend implies that BCH economic activity dropped significantly lower than the figures recorded in September.

Bitcoin Cash Total Fees vs. Price | Source: IntoTheBlock

The Total Fees metric measures the total amount paid by network participants to use services hosted on a blockchain within a given period. A decline in crypto transaction fees generated is a classic bearish signal, indicating slowing network demand.

This suggests the BCH price uptrend in recent weeks has been majorly driven by bullish traders speculating on the broader crypto market rally. Without a significant uptick in the network activity, Bitcoin Cash’s bullish price action could begin to lose momentum in the days ahead.

Read More: 11 Best Sites To Instantly Swap Crypto for the Lowest Fees

BCH Price Prediction: $250 Resistance Could Prove Daunting

From an on-chain perspective, BCH price looks on the verge of a mild retracement despite the positive market sentiment.

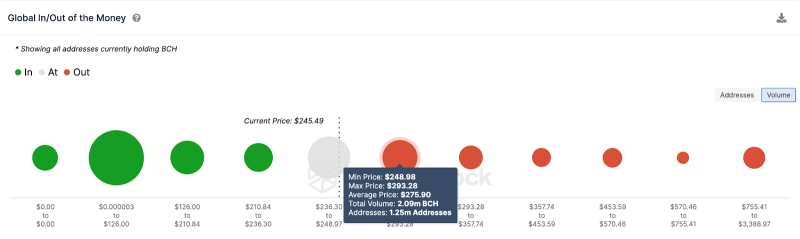

The Global In/Out of the Money data, which is an on-chain representation of current Bitcoin Cash holders’ historical entry prices, also confirms this prediction. It shows that the $250 area harbors the most significant resistance above the current BCH prices.

As depicted below, 1.25 million addresses had bought 2.09 million BCH at the minimum price of $248. If they close out their positions early, this could effectively trigger a price correction as predicted.

Bitcoin Cash (BCH) Price Prediction | GIOM data | Source: IntoTheBlock

Alternatively, the bulls could negate that prediction if the Bitcoin Cash price surpasses $300. But in that case, the next resistance wall around $280 will likely stand firm.

The chart above shows that 1.51 million addresses currently hold 968,000 BCH bought at the minimum price of $293. Without a significant increase in network demand, Bitcoin Cash price is unlikely to clear that resistance.

Read More: Crypto Signals: What Are They and How to Use Them